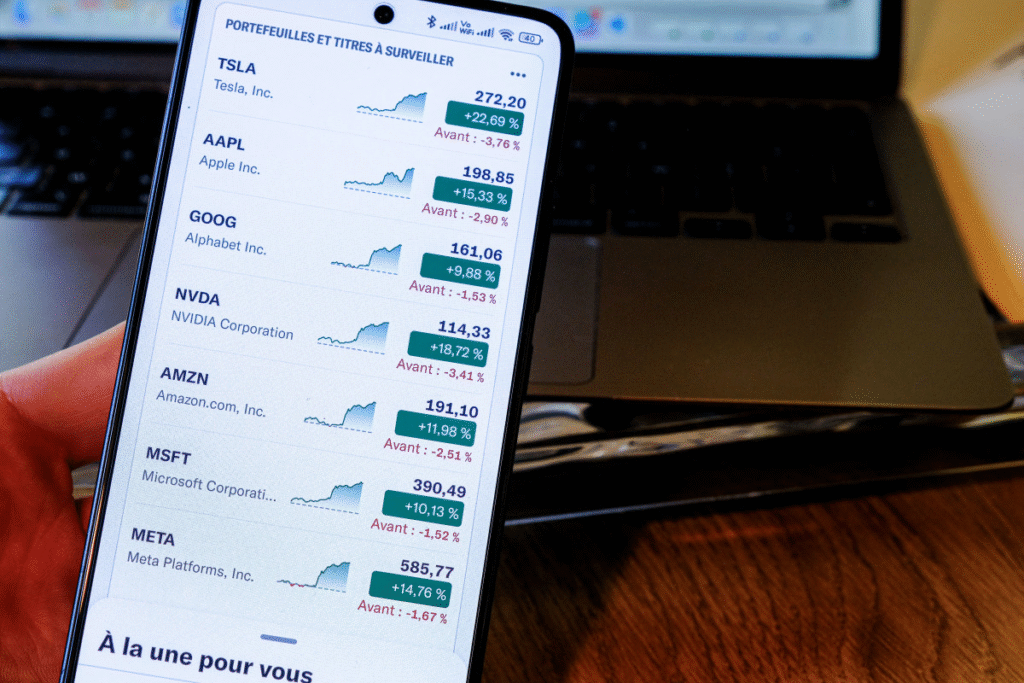

In the current market environment of 2025, investor enthusiasm is once again focused on some of the biggest names in tech: Tesla, Apple, and Nvidia. These three stocks have dominated buying activity this month, reflecting growing confidence in AI, electric mobility, and consumer demand. But what’s really fueling the surge—and what does it mean for broader portfolio strategy?

🚗 Tesla: Electric Dreams and EV Momentum

Tesla continues to attract strong investor interest, buoyed by impressive deliveries and EV market momentum:

- Robust Sales Growth: Recent delivery figures exceeded expectations, especially in expanding markets outside North America.

- New Product Pipeline: Investors are betting on the upcoming Cybertruck and further development of autonomous driving technology.

- Energy Expansion: Tesla is scaling its solar and energy storage business, diversifying revenue beyond automotive.

With optimism around both innovation and execution, Tesla stocks remain a favorite among growth and momentum investors.

📱 Apple: The Stability of Ecosystem Strength

Apple’s stock remains a cornerstone of large-cap portfolios, driven by a resilient ecosystem and service revenue expansion:

- Steady Product Sales: iPhone upgrades continue even in saturated markets, supported by longer device lifecycles and trade-in programs.

- Service Growth: The Services division—spanning the App Store, iCloud, Apple Music, and other digital offerings—maintains strong margin contributions.

- AI Integration: Apple’s rollout of AI features in upcoming iOS versions and new devices is boosting investor confidence in future monetization.

Investors appreciate Apple for its mix of innovation and reliability in a volatile market.

💡 Nvidia: The Powerhouse Behind the AI Revolution

Nvidia still stands at the center of the AI infrastructure boom, making it a primary target for institutional and retail buyers alike:

- Dominance in AI Chips: Nvidia GPUs remain unrivaled for AI model training and inference workloads.

- Data Center Momentum: Sales to hyperscale cloud providers, research institutions, and enterprise AI users continue to surprise on the upside.

- Developer Ecosystem: The NVIDIA CUDA platform has become the standard for AI development, reinforcing long-term lock‑in.

With AI still in its growth phase, Nvidia’s stock performance reflects expectations of sustained demand and technological leadership.

Why These Stocks Are the Top Picks Now

1. Strong Themes Driving Demand

Tesla, Apple, and Nvidia each align with structural trends: sustainability and EVs, consumer digital ecosystems, and AI infrastructure.

2. Institutional Support

Many mutual funds and ETFs have recently increased allocations to these names, using them as barometers for growth orientation.

3. Retail FOMO Factor

Retail platforms show increased trading volumes in these stocks as investors chase performance and brand visibility.

Potential Risks to Monitor

- Valuation Pressure: High multiples are inevitable. Any earnings miss or slowdown in revenue growth could trigger sharp pullbacks.

- Macro Headwinds: Economic weakness, geopolitical stress, or regulatory changes could dampen enthusiasm in high-beta tech names.

- Emerging Competition: For Tesla and Nvidia, pressure from new entrants—such as EV manufacturers or alternative AI chip makers—could shift the landscape.

Investor Takeaways & Strategy

✅ Use Core Positions Strategically

Given their liquidity and market leadership, these stocks can form a solid core for growth-oriented portfolios. But consider scaling exposure relative to risk appetite and valuation.

✅ Balance with Sector Diversification

While Tesla, Apple, and Nvidia lead gains, balancing with defensive sectors (like utilities or consumer staples) can reduce volatility.

✅ Layer Exposure Thoughtfully

Tranches over time—or using dollar-cost averaging—can soften the impact of short-term swings while preserving upside exposure.

✅ Watch for Catalysts

Upcoming earnings reports, product launches, and macro data releases (like Fed announcements or GDP revisions) may significantly influence near-term performance.

Conclusion

Tesla, Apple, and Nvidia are not just the most bought stocks this month—they’re emblematic of the dominant themes driving the market in 2025: green mobility, seamless consumer ecosystems, and the artificial intelligence revolution.

Yet with prominence comes volatility. Savvy investors will harness the momentum while mitigating concentration, staying alert to macro and sector-specific risks, and treating these names as opportunities—not certainties.

Whether you’re refining a growth-heavy portfolio or adding exposure to market leaders, these three stocks are a key focus—but best approached with both curiosity and risk discipline.